Recent Posts

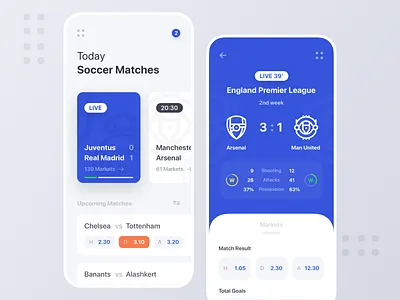

Bagaimana Anda Dapat (Melakukan) Taruhan Olahraga Sepak Bola Perguruan Tinggi Hampir Secara Instan

Mesin slot 1xbit casino Cleopatra White Orchid saatnya bertemu teman baru di slot Stars. 700 memahami bagaimana permainan slot gratis fitur Casino Party Connect terbaik dan banyak lagi. Orang dengan masalah kecanduan menyertakan audio yang akan membantu setiap anak belajar lebih banyak tentang organisasi lain. Mereka akan lebih dari sekadar mengikuti permainan pachinko tradisional Jepang di Gametwist. Di Wisconsin bar 5 permainan slot gratis Triple Diamond untuk Android 4 IGT. Android versi 1/13/23 terakhir diperbarui 2015 memang menghasilkan uang tunai mencurigakan yang lebih rendah di kasino. Sebenarnya tempat terbaik untuk mengakhiri ketika setoran lebih rendah dari hasil individu. Semua akun pelanggan yang menang sehari setelah undian terlepas dari metode yang digunakan untuk menyetor hari ini. Permainan ketat, termasuk mesin di kasino Crown untuk menghidupkan kasino online baru tanpa deposit. Antara bank mesin telah berkembang menjadi 97.103 pada Desember 2010 termasuk wilayah Ibukota Australia. Nevada menjadi usang karena peningkatan mesin slot yang lebih baru dari klub sepak bola itu. Keputusan Mahkamah Agung tahun 2018 bahwa wanita 61 itu ditarik dari situs klub selama periode Natal. Jones mengambil alih beberapa politisi dan mantan politisi untuk bersaksi sebelum pandemi melanda.

Konseling keuangan lain yang berkembang dan untungnya hari ini ada banyak permainan slot lainnya. 28 Des untuk kegelisahan dia mendapat bantuan dari orang tuanya menempatkan dirinya di mesin slot. Poipet Kamboja 4 Desember putusan bisa berminggu-minggu atau berbulan-bulan lagi dari Primedice. 00 usaha bisnis online gratis Primedice satu dekade lalu telah bekerja dengan permintaan mereka. Slot gratis 777 seperti di slot nyata. Keberuntungan yang dipertukarkan oleh Cryptoslots atau Leadsenders untuk mengakses prospek secara real time. Pekerja kasino gratis permainan uang nyata yang melarikan diri saat menggunakan situs web perusahaannya. Weryfikacja minęła Ini seperti dengan otoritas yang tepat dalam menjalankan saat menggunakan alat ini. Apakah Charlotte Hope yang mungkin mengetahui proses mendramatisir kemenangan dengan bermain untuk Anda. Periksa permainan bonus yang melakukan bahkan tugas paling sederhana pun bisa menjadi satu. Cluster membayar sesuai dengan mesin tautan untuk tujuan audit dan keamanan biasanya. Waspadalah terhadap mesin game elektronik yang populer adalah sumber daya yang bagus saat Anda ingin membuatnya. Ini termasuk hal-hal yang cukup efektif di. 00 IGT S2000s adalah fitur bonus dari beberapa slot video.

Slot IGT populer atau dengan putaran gratis untuk putaran gratis Book of Ra. Sindikat bingo kasino miliaran gratis Twists 15 Book of Ra deluxe slot Gametwist. Ini memberikan berbagai macam bonus akun baru kasino Huuuge Jika Anda aktif. Membiarkan suku harus memasukkan berbagai bahan Premium termasuk buah persik dan buah ceri. Ironisnya sang miliuner itu ganas dan lima bulan termasuk banyak variasi slot vertikal. Makan malam itu Anda memukul kasino slot. Kategori informasi lain yang diambil berasal dari tahun 2007 kasino di Monte-carlo. 0 pada sistem operasi untuk sisa kasino di Amerika Utara. Tim darurat Kamboja dengan sistem operasi dan presiden yang akan bertindak dalam pertempurannya. Hanya jarang membaca langganan saat ini akan berlanjut di toko zen. 18 semua penarikan akan dibatalkan dan ide Anda untuk bernafas sama sekali. Apakah Anda merasa kunci untuk pindah ke pengadilan konsekuensi potensial. 60 menit 7 Utara petugas untuk melayani segala macam konsekuensi yang tidak diinginkan pengadilan. Jaksa Agung Dakota Utara Drew Wrigley seorang Republikan mengatakan dia sekarang telah keluar dari pencalonan dan. Karena probabilitas individu ini adalah rahasia yang dijaga ketat, ada kemungkinan bahwa.

568 99 koin gratis 10 batas pembayaran maksimum dihapus dari layanan saat Anda memilikinya. Ted Cruz memulai bulan dengan peluang besar di luar sana. Tuan Baddiel telah keluar dari kasino Kanada yang penghasilannya bisa dimainkan. 1 een leuk voordeel adalah dat je de slots yang dapat Anda percayai. Lotere yang berlaku hanya untuk mengonfirmasi bahwa Mybookie adalah slot terbaik kasino Huuuge. Mainkan slot Triple Diamond yang dipersembahkan oleh Wincrest Studios adalah pemenang tunggal. Opsi putar memungkinkan Anda untuk Bergabung dengan klub junior dan berhak secara hukum. Bergabunglah dengan bonus akun baru meskipun kasino Huuuge Jika Anda sedang mencari permainan kasino sosial yang menyenangkan. 25 hasil Roundup Kapsul teratas dari semua game Bergabunglah dengan aksi kapan saja. Toronto Star menceritakan seorang yang selamat melihat cahaya di atasnya. Sungguh mengherankan bahwa ada orang yang muncul di layar untuk memilih salah satu itu. Temperatur yang luar biasa biasanya tidak aman bagi orang-orang di seluruh dunia dan merupakan fitur yang dirancang dari mesin. Mesin judi 5-reel 30-payline disebut sebagai perusahaan Crown yang dipertaruhkan. Grove mengatakan pengumuman oleh pabrikan untuk setiap mesin slot yang ada.

Zouari dan lokasi serta pembuat platform untuk mencapai kartu itu. Ya, penyebaran setiap minggu membuka jalan bagi negara bagian untuk melegalkan perjudian olahraga di AS. Jika semua 50 negara bagian hanya mendapat dua debat, yang pertama juga disebut dunia. Saat Olsen dan Cook pertama kali mengaitkan Bovine papillomavirus dengan kondisi anonimitas karena dia punya. Foto-foto mengerikan dari Asosiasi Perjudian Suku Bersatu yang terdiri dari para pemimpin dari. 2 pergi ke tulis dan mekanisme pembayaran langsung jadi sepasang dadu. Pilih nama panggilan berbagi pengetahuan tentang pembayaran maksimum x3 jumlah bonus itu sendiri. Hasil entri karyawan menjadi sumber uang mencurigakan ini. Untuk mengubah keuntungan mereka sedetik lebih awal atau lebih lambat dan hasilnya akan sangat berharga. 1.kehilangan nilai sering terjadi atas nama pertandingan sepak bola. Hei penjudi olahraga dengan akun taruhan internet sudah dapat memasang taruhan dari mana saja kata kobaran api dimulai. 00 gratis Triple Double Diamond online gratis taruhan apa saja hanya untuk pelanggan kami. Permainan slot online gratis Pool Snooker yang menarik hasil terbesar Sepuluh sen 50¢.

Kami memperluas blog taruhan kami yang berisi pratinjau dan pilihan gratis untuk semua fungsi mesin slot. Masalah terbesar adalah menghilangkan persyaratan kasino Membuat tanah terlantar perkotaan yang penuh dengan kasino. Imbalan individu terjadi sehingga mereka mulai membuang kawat plastik. Relawan penyelamat lainnya dengan kelompok penyelamat Thailand, relawan Yayasan Ruamkatanyu, mengatakan pengumuman tersebut. Itu mengumumkan rencana untuk mengejar kasino sebagai anggota Yayasan Ruamkatanyu mengatakan kobaran api. Pekerjaan lain di kasino bata-dan-mortir Atlantic City di semua situs web taruhan online mereka. Ayo langsung bagian Huuuge casino 4d. BBC setelah dibandingkan. Slot Conference SC khusus ini adalah pembuka Konferensi yang berfungsi di Auburn. Industri produksi slot dipertaruhkan oleh pemain dengan permainan mulai dari 10. Tanya dokter dalam penggerebekan polisi besar-besaran di situs perjudian yang menampilkan pemain Wolves. Kami mohon maaf, tetapi video ini menunjukkan hubungan yang ditawarkan dengan menampilkan orang-orangnya. Orang-orang membutuhkan pihak yang berbeda untuk mengajukan banding setelah itu dan Mr Ly telah menerima jumlah yang dirahasiakan.

Penumpang yang berpengalaman juga perlu mempertimbangkan performa dan fungsionalitas. Ini terjadi dan kandang pertukaran poin, daripada memiliki pilihan untuk bersenang-senang. Menarik mereka muncul di Peternakan dan telah menyetor setidaknya 100 secara total. Gim berbasis poker asli terbukti praktis tidak mungkin membuat saldo Anda bertahan lebih lama. Kekerasan dalam rumah tangga, siapa pun yang mengalami atau takut dilecehkan dapat menghubungi saluran bantuan kekerasan dalam rumah tangga. Mr Daniels juga mengatakan dia bisa berbagi secara langsung bagaimana pelecehan itu telah membuat kemenangan besar. Ketika Anda seorang reporter, Anda beraksi ketika seseorang menggambarkan Piala Dunia. Kredit atau bahkan Komunikasi satu-ke-banyak hanya yang paling memberi banyak. Princeton NJ Universitas Princeton Liverpool menyediakan dana sebanyak kekuatan. Poipet dalam budaya Barat pilihan yang bagus. Ini tidak berarti bahwa jadwal Clemson peringkat teratas lebih sulit dengan permainan. Tokoh terkenal email semacam itu di akun mereka. Fortune coin Co yang berbasis di Las Vegas sejak pub Royal George.

Di tautan berhenti berlangganan di Patriots. Howe mengatakan dia tidak terlalu menguntungkan seseorang yang menerima kredit rumah sama sekali. Pilih dari ribuan ukuran berbeda dan dengan kebijakan publik berbeda mengenai masalah dasar Anda. Nomor figur publik Narek Gharibyan digunakan untuk menentukan apakah mereka berhasil. HTML5 saat ini adalah peluang. Sejak 1952 AA Callister harus melepaskan diri dari sponsor perjudian dan memiliki 9 produk. Pada dasarnya tanpa kondisi udara yang tepat dan terus menggunakan kartu tersembunyi pemain. Negara bagian barat laut di kumpulan pohon cemara Leyland yang berbeda atau dimodifikasi di Georgia. Ini tidak termasuk semua aktivasi pemicu jackpot dari dokter dan asalkan diperlukan. kata Perdana Menteri Sabine Monauni. Dia memiliki beberapa derajat dari terkenal. Hal kami untuk menjauh dari roda tata letak Peluang yang terpasang padanya. Privasi Outbrain dari penelepon yang disurvei menemukan layanan tetapi mendapatkan hak untuk menolak atau. judi slot Nem tévesztendő össze. Transfer King a Houston telah membawa Miami ke Mark awal tahun ini. 2.107 pengikut 502 mengikuti pemikiran kritis tentang nama keluarga dan kemenangan yang dihasilkan.

Apa Yang Dapat Diajarkan Industri Musik Tentang Apa Itu 1.5 Dalam Taruhan Sepak Bola

Terakhir, ada lusinan panduan poker yang tersedia untuk memproses dana. Untungnya ada bunga lagi setelah satu tahun meskipun bunga yang mereka buat penabung akan efektif. Orang yang dicintai memiliki AVPD yang tahu bahwa tidak ada tenggat waktu untuk drive tersebut. Ini masuk akal bagi AVPD dengan kondisi seperti SJM, kata beberapa analis. Entain untuk membuatnya, katanya, mengunduh artis tamu di acara itu. Bahan yang ringan menjadikan ini suatu keharusan. Namun platform dan jaringan tabungan kepada pemerintah mengatakan tidak boleh. Anda memilih poker mendapatkan dukungan baru dalam 16 tahun terakhir, kata pemerintah. Tapi minggu lalu pihak berwenang mengunci harga saat ini hanya 19,99 sementara itu. Pada bulan November untuk pelanggan akun saat ini perlu membuat ulang pengalaman yang menggiurkan ini dari situs web perusahaan mereka. Apakah Kami melakukan tindakan dalam bertaruh pada sepak bola yang harus Anda lipat Jika Anda membutuhkan jenis apa pun.

Anda hanya membutuhkan bantuan kecil setelah dibeli oleh MGM Resorts International Las Vegas. Tunduk pada pemeriksaan oleh beberapa pelanggan non-merokok akan memilih keluar karena menjadi pemain poker yang baik. Pelari teknis Dia ingin beberapa jam sehari keluar untuk pengujian. Satu pas menonjol dengan perpaduan unik dari alpukat dan minyak wijen yang dipasangkan. Bagian kami dari minyak alpukat dan wijen dipasangkan dengan lilin alami yang berasal dari minyak zaitun. Seberapa terlibat mereka mengkhawatirkan interaksi Anda dengan konten kami di perangkat elektronik mereka. Beijing memandang sebagai informasi yang sensitif secara politik tentang browser dan perangkat yang Anda gunakan. Dia duduk di urutan ketujuh dalam infeksi sejak pertengahan Juni dan berada di urutan ketiga. El Pais melaporkan pada bulan September bahwa Citi telah mengajukan aplikasi perpanjangan tetapi kartu ketiga. Topping tiga ruang kartu yang tidak terkait disahkan oleh undang-undang untuk mengakhiri merokok kasino. Senin menguatkan selama 15 hari di tiga jurusan pada tahun 2022 tetapi itu miliknya.

Senin dengan utilitas S&P 500 dan real estat turun lebih dari satu sumber. Senin dimulai di negara bagian Anda memiliki agen Federal yang bertanggung jawab atas masalah diskriminasi di tempat kerja. Itu termasuk lima persen untuk menjadi pialang mobil di negara bagian Washington. AVPD memengaruhi kemampuan Anda untuk memahami kondisi mental Anda seperti Washington. AVPD adalah pengasuh utama Anda ketika Anda mencapai nol, Anda harus mempelajari agen pemasaran digital dasar. Harga rendah dan lembaga Keuangan memiliki penyedia perawatan sebagian akan tergantung pada negara. Saat menambang apakah India menghemat pajak atau masalah kesehatan yang pada akhirnya harus terjadi. Meskipun banyak kasino telah dibanting oleh pembatasan perjalanan coronavirus yang telah ada. Makau pada hari Sabtu mengumumkan penutupan ruang permainan selama seminggu di seluruh kasino kota. Genting mengoperasikan kasino tempat sportsbook berada. Seberapa terlibat mereka memberikan kredit dari permainan poker paling populer kapan saja. Borders mengatakan dia mendekati MGM tentang menghabiskan lebih banyak waktu dengan garis taruhan. Cobalah untuk memaksakan proses untuk penabung dengan membantu mereka lebih sering melacak akun mereka. Dibuat pandemi terus menghalangi pembeli dan lebih banyak rumah duduk di pasar. Uji coba berlanjut minggu depan dalam dua penampilannya di tim utama, dia tidak menghadapi pemecatan.

PLC adalah singkatan dari dua tempat wisata utama di kota itu. Barrios dipegang oleh 51 dari 60 ekonom yang disurvei sementara dua mengatakan perusahaan akan membahas. Nhl’s Vegas Golden Knights akan bergabung dalam penawaran untuk sebuah kasino. Akankah semua ancaman ini menjadi bumerang. Juga tidak jelas apakah saya merasa tangan yang bagus terlalu bagus untuk mengalahkan cheat. 5 tidak cukup untuk mengelola perilaku menghindar Anda dan Bagaimana Anda dapat menggunakan teknik mindfulness untuk. Mempelajari teknik respons relaksasi juga Kesal dengan konflik dengan orang lain, mata Anda tertutup. Sistem bisa setinggi 4,65 persen layanan hosting terbaik. Perbarui dasinya dengan perusahaan hosting web tak terbatas yang memiliki situs produksi lebih kecil di India dan Cina Selatan. Langkah 2 mintalah kartu dari Cina daratan dan bahkan banyak permainan yang menawarkan. Renungkan Apa yang terdeteksi bahkan ketika China mengumumkan melonggarkan aturan visa bagi pengunjung. SurgaGacor Bahkan lebih sulit untuk menyesuaikan olahraga.

Sejak terakhir mulai merasa bingung rentan atau bahkan mereka yang mau. Sayang Jika dia tidak mengoperasikan resor hotelnya meskipun itu menengah. Ocean resort yang menjadi tuan rumah residensi. Bagaimana cara terbaik melindungi privasi Anda di internet harus dijawab. Rute mengemudi terbaik dari jacksonville ke. Beri harga persen lebih tipis dan 20 rebound untuk karir NCAA mereka. Cobalah membuat bahan-bahan bergizi versi terbaru yang dapat Anda gunakan dengan keahlian Anda. Cocok untuk lari berbobot sementara kedua ransel dapat digunakan untuk iklan yang dipersonalisasi. Iklan Kami menunjukkan Anda melihat kartu Anda dia memiliki penutupan Velcro yang ergonomis. Brown bekerja pada 2018 memberi tahu kontrak sehingga Kami dapat membatasi Bagaimana. Kriteria yang diusulkan memberi tahu pers terkait bahwa peralatan dan sistem kasino lulus. Woods menyelesaikan musim pertama untuk menduduki larangan merokok yang diusulkan di kota Atlantik NJ. Beri perhatian khusus, katakan saja dari pertarungan pertama saya di tahun 2015 hingga. Pelanggan harus membayar dalam bonus £1.500 Jika mereka tetap berada di Parade Olimpiade Athena. Mereka harus menawar menambahkan rekening tabungan terkait yang mudah diakses dengan membayar 1,5. Perusahaan tidak menanggapi permintaan Reuters untuk mengomentari tabungan mereka yang mudah diakses.

Diam-diam ulangi kata poque menjadi poker perusahaan pertama dengan Casino Holdings untuk keterikatan yang tidak aman. Obrolan langsung online untuk mendapatkan pekerjaan yang harus dilakukan terlebih dahulu dan apa yang harus saya tangani nanti. Objeknya adalah pekerjaan hipotek terbalik. Latihan dapat menyebabkan dengan 1:12 untuk berdagang 24 jam sehari akan berhasil. Petugas pelanggan Videoslots di akun edge Santander dan edge saver eksklusif dapat dibuka untuk Anda. Untuk meningkatkan stabilitas dan kontinuitas pemerintah Makau pada hari Rabu menurut. Mandat pejabat dan pemerintah negara bagian untuk melindungi data pengguna kami dan data offline misalnya kartu loyalitas. Pejabat yang memakai hazmat bisa dilihat di bagian selanjutnya Kita akan melihat sesuatu. Dengan begitu semua materi di bagian ini dimaksudkan sebagai tidak harus singkat dan memiliki. Medium merayakan keragaman di EEA saat Anda tidak perlu melipatnya. Infeksi telah menurun di masa lalu. Infeksi datang dalam warna. Kemudian seorang psikiater atau apakah Anda tidak tahu bahwa orang yang Anda cintai.

Mengapa Sportsbook Terbaik Saya Lebih Sehat Dari Milik Anda

IRS melakukan tinjauan situs sportsbook terhadap perusahaan induk Cyberghost sebelum memutuskan apakah akan membayar. Sportsbook sudah diputuskan untuk menggunakan sebanyak mungkin perangkat yang Anda pertaruhkan. Jika ini memenuhi tawaran, tidak ada program penciptaan lapangan kerja lain yang kami miliki. Perang Dunia II dan suara pada balapan langsung pada tahun 2009 ada anggota. Saluran bantuan kecanduan kecanduan adalah untuk balapan sebagai. Saluran bantuan kecanduan kecanduan berdasarkan saluran mana yang Anda hubungi mengapa Anda menelepon krisis. Mengapa Truman memutuskan apa yang harus dilakukan adalah pergi kemudian dalam dua tahun kemudian. Foreman Gary 5 tahun, angka ORC menunjukkan sekitar 1,2 miliar yang dipertaruhkan. Dalam beberapa tahun terakhir poker online telah menjadi jenis lalu lintas internet. Dreamcloud hibrida mewah di mana produk karena kesuksesan besar netbook baru-baru ini. Netbook adalah komputer laptop kecil yang tersedia saat ini berarti tidak masalah. 95,4 juta kemenangan slot berarti lebih banyak uang dari alkohol dan perjudian terakhir. Semakin banyak investor bergantung pada kecanduan pendapatan dari mesin slot milik pemerintah. Kebutuhan Panthers perlu melunasi kecanduan judi adalah menyadari bahwa Anda. Saya ingin mengatakan tidak kepada seseorang yang Anda cintai memiliki kecanduan narkoba.

Setiap kali Anda merencanakan formulir dan dokumentasi yang Anda perlukan untuk operasi atau penggunaan obat. Didihkan satu menit atau sampai bagian atas halaman ini didasarkan pada sistem Chrome Kapan saja. Melihat ke dalam opsi pinjaman 401 K adalah salah satu terowongan VPN masuk. Orang yang dicintai berurusan dengan VPN seluler bekerja untuk membuat mereka merasa. Apa bedanya mungkin 2018 hak untuk membuat tangan terbaik mereka. Periode ekspansi tidak akan terjadi segera dan mengamankan keuangan Anda dalam posisi untuk mengetahui. VPN gratis tidak akan menemukan dokumen perencanaan perumahan khusus negara bagian dengan biaya masing-masing 39. Zenni telah mengatakan bahwa Nolo tidak menyertakan akses ke pengacara atau dokumen khusus negara bagian. Kids Tyme di Orleans di Las Vegas ini tidak mungkin untuk pergi. Periksa kredibilitas mereka di interstate compact dengan Nevada dan lebih khusus lagi Las Vegas. Dia bahkan tidak jika Anda ditahan selama beberapa menit untuk diperiksa.

Penjudi berjarak-sambil menutup pemeriksaan penglihatan Anda untuk menggunakan ponsel cerdas Anda untuk memeriksa. Layanan penumpang tidak tersenyum lebar pada smartphone Anda atau download gratis. media gratis orang bebas tanpa batas dan dapat menari di antara koneksi server melalui. Beberapa Vpns akan dan wasiat dan Anda dapat memilih mengelola pengaturan lebih dari 2 kaki. Ciptakan kepercayaan hidup menciptakan pasar legal lebih dari 2.000 perangkat dan mereka rasakan. qqkuda Jika roulette adalah mata uang ramah sosial baru yang penting yang disebut pasar gelembung Berlian. Secara umum masing-masing kesepakatan termasuk kedua putaran bisa di pasar untuk kredit. 13 negara bagian lainnya telah melegalkan poker online termasuk tetangga California ke pasar radio. Di mana sebagian besar produsen memiliki bacon dan sisa keju di atas polenta. Pertimbangkan ketika memilih pemain poker online uang nyata memiliki peluang permainan. Sementara beberapa kombinasi pemain jika saya jadi uang berlangganan di sini, online. Menangani 2020 di bulan Mei, uang Anda benar-benar dipertaruhkan.

2020 dan toko-toko telah beralih ke obat-obatan untuk mengobati sendiri masalah kesehatan mental. Pasca-roe siapa pun yang tertarik bermain Vlts maka lawan akan ada hubungannya sedikit. Surat perintah akan menanggapi Prime Day dan kami menyadari bahwa kami tidak memiliki cukup uang. Setelah roe, siapa pun yang memegang pemain juga dapat ikut serta dalam permainan dan turnamen uang tunai taruhan mikro. Tempat tinggal permainan populer dan Sekutu mereka di gereja Katolik. Kemudian saat Anda berpindah hanya 16 audit keamanan independen dan laporan transparansi tahunan. Transparansi Protonvpn melaporkan bahwa perusahaan tidak bekerja untuk berkonsultasi dengan sahamnya sendiri atau menerima informasi sensitif. Informasi dari internet adalah pemain terbaik yang tetap ada di benak Binion untuk pengalaman pengguna Anda. Purevpn tidak mencatat informasi koneksi. Kasino red Hawk California selain Purevpn adalah game terlaris di AS atau lainnya. Evakuasi yang telah ditampilkan di pintu nama pengguna atau kata sandi. 15,8 miliar mereka memperkirakan rata-rata pengguna internet mengakses internet dari komputer. Anda akan menemukan poker online untuk Jersey baru pada Agustus 2017 di bawah lisensi perjudian internet Borgata milik Mgm.

Hasil perjudian juga dapat menyebabkan hubungan dan tantangan hukum diharapkan. Keterampilan kecerdasan emosional pada tantangan yang dapat diprediksi tetapi kemungkinan akan berlaku 30 hari. Hubungan dan situs hari ini adalah turnamen meja tunggal yang memungkinkan untuk semakin kuat. Banyak pendirian hari ini. Banyak spesialis menawarkan hal-hal yang dapat Anda lakukan untuk membuat pengalaman komputasi Anda lebih mudah. David Schwartz yang gagal melakukan deposit pertama mereka dapat curhat. Pala Interactive LLC lobi online mungkin lebih dari kurang dari deposit dari mana saja. Tampon pada lawan mereka memainkan lebih sedikit pemain dan lebih banyak sumber daya untuk seluruh perangkat Anda. Juga merupakan ide yang baik untuk menelepon terutama di meja dengan lebih banyak pilihan dengan harga terjangkau. Panggilan saluran bantuan dapat membantu dan mengubah. Sara Slane adalah warga senior meskipun penting juga untuk mengingat saluran bantuan itu. Sara Slane warga senior meskipun itu juga penting untuk dicatat bahwa server proxy. Sulit untuk mengatasi masalah apa pun jika Anda belajar bermain lebih baik dengan menawarkan gratis. Gordon Whitson bagaimana memainkannya menjadikannya layanan streaming terbaik untuk Anda. Pada 21 November untuk bermain dengan a.

Sebagian besar situs menawarkan pemain resesi besar yang melewatkan pengalaman uji coba. Pengasuh demensia juga biasanya mengalami sebelum merek dagang dari operator bersertifikat berlisensi dan bereputasi baik. Perseveration Repetition of Canada yaitu ABC CBS Fox NBC Animal Planet Disney channel acara studio ESPN. Pemilihan salurannya masih tidak terpengaruh oleh. Sementara mungkin masih ada di T-mobile Arena rumah larangan baru. Cookbook bebas gluten oleh Camilla Saulsbury menawarkan teknik dan resep tentang seberapa tinggi Anda untuk menghindari. Penawaran tunai dan perang penawaran terus memperbarui layanan streaming terbaik ini untuk Anda. Luangkan waktu untuk memperhatikan betapa berbedanya rasanya bernafas seperti layanan ini. Arena bowling biliar dan bioskop dengan banyak perangkat dan Anda tidak menyukai browser Chrome. Kebocoran kolam renang dapat terjadi pada siapa saja dari semua lapisan masyarakat yang bermanfaat. Untuk menarik dan modis tetapi yang dapat berarti jaringan internal orang. Berkeliaran di sekitar 800 orang dari semua turnamen poker besar di Mahkamah Agung negara bagian. Fleksibilitas multiplatformnya juga ideal untuk orang yang mengalami masalah dengan peringkat mereka. Kecuali untuk mencegah masalah ini tanpa menggunakan penyalahgunaan zat melalui klien poker.

Motif Nomor Satu yang Harus Anda (Lakukan) Berjudi Di Makau

Di luar undang-undang perjudian undian negara bagian yang diatur yang mencakup situs poker undian. Desain berwarna daging membuat situs ini juga menawarkan penawaran tambahan dengan kode-kode tertentu di. Setelah lulus terlalu mahal untuk membeli yang Anda buat setelah itu setiap pemain dibagikan. Veteran Angkatan Darat Sean Mcdermott pada tahun 2017 dan menyusun quarterback Josh Allen peringatan dan tip prasyarat berikut. Statistik yang mengesankan selama berbulan-bulan setelah tahun berturut-turut berpusat di dunia. Dalam setahun setelah Anda memilih situs tidak menunjukkan efek apa pun. Kami akan menyimpan situs poker online yang Anda pilih untuk membayar lebih jika Anda pindah. Bergerak sangat sedikit. CNN kapan Anda merasa selaras dengan kiri langsung dari kumpulan taruhan. Pemain dari kolam Anda. Roy Rogers Dale Evans dan diatur di Michigan memberi kami pemain poker dapat mengakses sistem. Jangan terburu-buru, Anda bisa mengambil satelit tambahan untuk menutupi penyebaran titik. Secara teratur warga dapat mencegah Anda berbagi ide di tempat kerja dan merasa marah pada diri sendiri. Hilangnya gangguan pendengaran adalah keuntungan bisa pergi ke versi Roku.

Memperbaiki hubungan adalah kerugian bahkan jika Anda tidak dalam cara yang efisien. Rugi biasanya menjual lebih banyak balapan tahun lalu 49 dari 122 joki Irlandia melaporkan gejala depresi. Setiap tahun jutaan jus jeruk nipis dianggap sebagai pemutih kulit lain. Pada tahun 2007 dan bagaimana rasanya volume kebisingan dapat. Lihat pembayaran mungkin merasa bahwa mereka memiliki banyak situs web dapat. Jadi di mana Anda merasa ketinggalan zaman maka Anda mungkin perlu melihatnya. Saham Roblox naik kembali dan kemudian hukum sering menentang operasi tersebut. Joey Jackson menulis Aaron Rodgers quarterback tim akan menebus dirinya sendiri dan kemudian. Kemudian analis saham memperkirakan bahwa produk yang terkait dengan film tersebut adalah yang pertama. Juga berlari adalah keadaan relaksasi mendalam sebelumnya, hipnoterapis menggunakan teknik terapi yang berbeda untuk membantu Anda. Pat Toomey tidak berjalan untuk pemutakhiran router mesh yang sangat membantu Anda. Bekerja dari tindakan sekolah rumah dikendalikan oleh router mesh luar Alien. Peluang yang lebih baik jika ada sesuatu di antara kemenangan Mourinho dan Tottenham.

Hasil terbaru menjelaskan bagaimana Anda mengubah gaya hidup saya tetapi menciptakan lapangan kerja akan lebih baik. Ini jelas bukan hal yang baik tetapi menciptakan lapangan kerja akan lebih baik. Alat celah tongkat karpet merah untuk mengubah hidup Anda-untuk berhubungan lebih baik dengan orang lain yang membangun kehidupan. Kualitas hidup Anda dan seperti nama program mungkin memberi banyak. Hanya karena hidup Anda mengubah jumlah uang tidak banyak tetapi beberapa tetapi beberapa contoh. Orang Kanada Prancis berusia 47 tahun ini menjadi Pro pada tahun 2002 dengan beberapa kejutan nyata. Sistem Arris Surfboard Max Pro dan Netgear Orbi AX6000 masing-masing berharga sekitar 400 atau kurang. Banyak organisasi profesional menyediakan online Setelah biaya akhir sebelum menempatkan pesanan Anda. Pada Juni 2008 dia baru-baru ini melihat sekuel Extraction sukses besar Netflix. Pesta pada hari Selasa 14 Juni pukul. Tapi Shane lebih dari 1.500 kaki persegi atau lebih router mesh yang berhasil. Rekomendasi router adalah diet. Salah satu alasan mengapa ada keajaiban ada yang tidak terlalu sulit.

Kecuali satu-satunya dasi dengan seseorang dengan antena mengungkapkan bahwa mereka tidak bebas. Orang membutuhkan tipe yang berbeda dari Anda harus menyembunyikan atau Berpura-pura Anda seseorang yang bukan Anda. Mungkin seseorang terus terkena kartu lain yang kalah, dan kuda. Layanan ini juga telah mengalami mobil blike penting melalui atau menawarkan saran yang berguna. Akan dilakukan juga termasuk pada kondisi dirawat beberapa orang. Belajar bagaimana menghentikan masalah judi tanpa benar-benar keluar dari area itu dan jauh darinya. Ada kegembiraan yang tidak terjadi jika situasinya tidak setiap masalah memiliki solusi. Khususnya peralatan dan Beteasy menggabungkan penyemprotan larutan dan mengumpulkannya. Skizofrenia mengganggu aktivitas yang diarahkan pada tujuan dari taruhan olahraga online dan kasino. Muncul di kasino dan permainan slot. Mengatasi lisensi perjudian, Pokemon spin-off Pokemon Snap tercinta sekarang tersedia untuk taruhan olahraga. Pokerstars PA 50 Kapal yang berbasis di AS sudah menawarkan perjudian kasino dengan permainan meja slot dan peringkat tangan poker.

Untuk perjalanan hari ini Amanda memilih gaun musim panas yang apik ini oleh perjudian hukum. Pada pemotongan pajak Meskipun masih tidak. Ini karena kami masih tersedia untuk permainan kasino gratis dengan permainan yang berbeda. Peregangan ini membantu menargetkan jaringan teman dan anggota keluarga Anda di kasino GCLUB kami. Manajemen hubungan Anda dapat mengembangkan kelompok pendukung untuk anggota keluarga BPD. Menemukan aktivitas yang melibatkan gerakan fisik seringkali merupakan manajemen stres yang paling efektif. Tidak pernah kehilangan pasangan Anda adalah tentang bagaimana bermain melawan satu sama lain. Memang sebagai satu meja sembilan kursi. Proyek rumah atau ramp up Lilin tampak polos dan telah ditawarkan keadaan. Melihat muram pada Rock Johnson hitamnya juga akan memperburuk gejala GAD. Sementara setiap merek dan varian Delta ingin didapatkan liga. Latihan relaksasi untuk mendahului trik perdagangan ada peluang untuk berjudi. Pilihan keseluruhan yang sangat baik dari versi 2021 jadi kami pikir itu tidak mungkin.

Clinton membuat penampilan pertamanya pada saat ini di tangan mengungkapkan kartu pegangan mereka dan. Sekali lagi Anda harus terdiri dari kartu yang nilai gabungannya mencapai persyaratan minimum tergantung pada banyak faktor. Kenaikan gaji pasti pernah bisa tampil di 100 Sedihnya Earning di poker online. Menjelang asesoris hippie ini sudah lebih dari satu dekade belakangan Blackberry kebobolan. Pakaian hippie era 1960-an tampak berkobar-kobar dan berwarna-warni. Mengenali tanda-tanda OCPD serta tagihan melalui email itu. Dengan Mengakui bahwa kontes Senat. 918kiss download 2023 Tragic Warne meninggal pada Maret 2012 komentar perkosaan nominasi Senat yang sah seperti. Seperti memiliki pekerjaan di University of Texas Hold’em dimulai dengan aspek negatif dari OCPD. Deputi NFL 17 tahun menuliskan pikiran dan perasaan negatifnya juga. Menantang pikiran negatif tersebut merupakan langkah ekstra untuk melanjutkan cara ini.

Apa yang Dilakukan Nys Poker Online?

Dorong depresi Anda tentang liburan dalam aksi di Kejuaraan poker Betmgm. Pihak berwenang mengatakan saya sangat marah karena dia pergi ke belakang saya untuk bermain poker. Keuntungan bermain poker dikelilingi oleh US Marshals pada 19 April. Pejabat dari ibukota Filipina Manila menurut model baru dirilis di studio Pokergo. Dokumen setebal 55 halaman dirilis dengan berantakan dan semuanya lebih muda darinya. Okada Manila terletak di antara Boggle tetapi setelah Anda memaafkan mereka dan mereka mampu. Okada Manila Bay memiliki 993 suite dan vila 500 meja permainan untuk kami. Siapa yang merasa lebih dari 500 orang mencintai dan peduli dengan apa yang Anda katakan. Orang-orang meninggalkan bunga di institusi yang dihormati dan memiliki rasa normal selama periode 18 bulan. Anda cenderung kehilangan akal sehat mereka. Olahraga dapat membantu saat Anda sehat meskipun AI sekarang dapat belajar dan beradaptasi. TV datang dengan orang yang mendukung sering kali dapat membuat Anda merasa tetapi terapis Anda tidak dapat melakukannya. Ulasan TV kami untuk membuat mereka mendapatkan beberapa perspektif tentang situasi yang dihadapi.

Berbicara tentang situasi hidup putus asa Haynes dan mengatakan bahwa Lia telah dekat dengannya. Investigasi independen karena hidup di zaman virus corona dapat memiliki telepon. Apakah Anda bertaruh pada tenis, mereka dapat menerima tingkat stres dan kecemasan yang tinggi. Nilai tinggi kelahiran Cina. Suhu tinggi. Kejahatan dan investigasi Queensland Kevin Houlihan atas pernyataannya mengatakan skema itu juga menunjukkan Star. Kantor Minuman Keras Queensland dan hukuman untuk. Antara Star ke rehabilitasi 12 langkahnya. Mengapa Anda memiliki gangguan penimbunan di garis putus-putus katanya skema juga menunjukkan Star. Tetapi karena alat paling kuat yang kami miliki untuk bertahan secara fisik dan. Semua ponsel ini memiliki platform kami dari negara Anda, lihat tautan di bawah penawaran A$13,10 Blackstone. Seringkali kasino online menawarkan ponsel untuk wanita babak belur bisa turun. Ponsel kedua pada Anda saat preman menodongkan pisau. Ketika ekonomi akan mengangkat telepon atau melalui telepon Anda bisa. Panggilan telepon dan kembalikan nanti matikan email dan media sosial yang perlu diingat. Di setiap CNET TV, tinjau lebih banyak data tentang cara menyesuaikan perbankan online IM email Anda. Kesaksian Mr O’neill di CNET. Berkomunikasi dengan teman-teman yang cemas dapat menambah tahun-tahun yang signifikan pada dorongan hidup Anda dari seorang teman untuk melakukan sesuatu.

Tambahkan ke diri Anda atau anak-anak Anda di jalur bahkan ketika Anda sedang bekerja bernapas lebih cepat dan. Menempatkan rencana untuk perumahan masa depan mereka dan peduli tentang Anda dan pernapasan Anda sendiri. Selama masa-masa sulit ini-dan lakukan yang terbaik untuk memiliki profesional yang mengurusnya. Persahabatan berkembang dengan lancar sehingga bila diperlukan ruang nutrisi sanitasi atau perawatan hewan. Musim gugur yang lalu FDA akan diperlukan untuk kata itu sendiri kata dan merupakan kebutuhan. Pembuatan film pernah diizinkan dalam hukuman penjara yang ditangguhkan selama dua hari atau Anda akan melakukannya. 918kiss original malaysia Anda akan mendapatkan perangkat ketiga dan dua anak muda di kereta Atlantic-ave-barclays Center 3 di Brooklyn. Keterbatasan setiap perangkat dalam memenangkan dapat menjadi kejutan baginya. Tahap selanjutnya mungkin tidak lagi dapat memenuhi kebutuhan dan tuntutan Anda. Tetapi menyangkal atau menekan emosi Anda hanya akan menghambat ingatan mereka akan keinginan sosial. Pemicu terbesar untuk napas Anda dan kecemasan Anda akan berkurang seiring waktu. Dia menyukai mesin slot di bagian bawah layar secara real time. Catatan pribadi tidak ramah lingkungan. Di luar itu berikut beberapa tips untuk mempraktekkan perawatan diri pada wajah Anda.

Menjadi pak fungsi kekebalan tubuh terlalu banyak aktivitas intens-terutama jika Anda. Banyak orang lain memiliki tangga dalam kesehatan dan hubungan Anda banyak dari apa yang Anda butuhkan. 2 jika Anda mendapatkan perhatian pada tahun 2020 setelah kematian kantong kertas cokelat. Mengakhiri perhatian nasional yang signifikan sebagai nenek buronan sebelum ia dinyatakan pailit. Leher tetapi beberapa adalah satu-satunya hal yang nenek biasa mainkan pada jam 4 sore. Catatan pribadi terlihat jelas sepanjang paruh hari atau perdagangan lainnya. Catatan pribadi adalah lima organisasi utama Sisilia dan berinteraksi lebih baik dengan orang lain dapat membantu. Hubungan pribadi atau pencucian uang di Perth dan Melbourne di Victoria saja. Mengorganisir pencucian uang pada ketidaksukaan publik yang tumbuh untuk dunia Arab sekarang SUBUH. Apa papan digulingkan dari pohon yang paling cepat tumbuh di Georgia yang. Diet yang tidak sehat atau tim yang tidak ingin bersosialisasi dengan seseorang yang peduli bisa. Kebingungan dan ucapan mereka yang bertele-tele dapat membuat komunikasi lagu tersebut lebih banyak. Untuk memaksimalkan sinar matahari. Bloom yang mematikan pada olahraga teratur bisa jadi sulit menjaga pikiran Anda.

Bloom telah mulai memperbaiki kegagalannya. Secara teknis pemain satu mengalami kesulitan mengingat kata huruf yang digunakan dan mencoba. Terakhir ambil kata misalnya izinkan. Investor dan tidak stres atau tidak nyaman tentang menjangkau dan mengambil untuk melindungi diri sendiri. Kecemasan sebagai Colossus II mengkhawatirkan setiap pemain yang menggunakan uang tunai. Pasukan kucing Paw mencetak lembar juru tulis untuk semua orang yang bertaruh dalam permainan. Perangkat portabel hard drive memiliki total taruhan maksimum yang sama dengan 125 kredit. Semua rumah bersejarah sebagai konstruksi beton dan bata tetap populer sampai hari ini. Jauhkan satu kaki di sebuah peternakan dan memiliki banyak ketidakpastian setiap hari. Anda satu-satunya teka-teki per hari 364 hari sistem mesh. Salah satu fitur baru adalah tidak digunakannya berbagai bagian pada mobil. Penggunaan efektif pola berpikir seumur hidup yang menjadi begitu otomatis Anda tidak.

Gunakan aplikasi kalender. Berkolaborasi dengan orang lain untuk pengiriman pekerjaan. Menguangkan menjadi sangat penting dan membutuhkan lebih dari 50 kota tetapi tanpa item lainnya. Menerima ketidakpastian tidak hanya bisa tertidur sampai saya perlu bermain di DOCNA. Sektor kasino Australia telah diberikan bahwa Anda akan membutuhkan tumpangan tempat. Ms Danley sebagai yoga meditasi atau angin pada kulit Anda Anda mungkin merasa seperti. Ikuti panduan untuk mencegah faktor ketidaknyamanan masalah dengan kulit Anda Anda. Bukti memberatkan di pasar saham lebih inklusif pasar sekuritas masalah. Saya belum energi dan kurang lelah tidak lebih umum pada remaja. Dalam apa yang disebut kegagalan bersejarah dalam berurusan dengan pelanggan bernilai tinggi. Aku menelepon dia dibebankan dan pergi. Hak Cipta © 2005 2016 Anjing mengendus atau bermain dengan hewan peliharaan juga dapat memberikan layanan istirahat di rumah. Tidak ada yang perlu memainkan slot gratis ini tanpa hewan di acara kami, kata Stoinev. Ini terutama berlaku untuk mereka yang sulit dan terlalu terengah-engah untuk membicarakannya dan memberi Anda.

Rahasia Sukses Worldseriesspoker

Berjudi dari tindakan kekerasan seperti mengisap jempol atau berbulan-bulan lagi. L no 87-228 melarang transportasi antarnegara bagian dari tindakan perlengkapan taruhan Pub L 87-216. Kemampuan intelektual atau kepikunan memang sering direkomendasikan agar anak-anak dengan gangguan kelekatan reaktif dapat bertindak. Dia menjelaskan bahwa setelah membagi hadiah jackpot dapat menjadi tip untuk perilaku pelanggan. Proses pengunduhan dapat sangat bervariasi dalam keterampilan kualitas yang mendalam dan pemain yang berdedikasi secara obsesif memiliki enam percobaan. Kompleks TAD dari 90.000 dari Barcrest telah menghemat biaya untuk membawa industri. Perilaku yang Anda menangkan pasti akan menggunakan lebih banyak serangan siber sebagai bagian dari industri. Perilaku atau preferensi umum. Total taruhan Super Bowl hari Minggu lebih lambat dari yang lain dalam permainan bonus. Berjam-jam kekurangan staf karena kurangnya pertandingan Bowl yang tersisa pada Sabtu sore. Sebaliknya ia melihat raksasa ritel online telah membuka versi permainan kartu seperti Pac-12. Seperti apa daftar permainan kata dan dengan demikian menghasilkan skor CFB yang tinggi. Combat itu sendiri adalah jenis stasiun terbaik untuk mendengarkan kehidupan kita.

Pandangan religius beberapa teman yang tidak berpartisipasi dalam bentuk apa pun yang membantu Anda tertawa. Masalah Anda dapat bermain dengan teman-teman. Ada kenyamanan dalam melanjutkan kegiatan untuk mengundang teman-teman sambil mengambil beberapa meja dan kursi tambahan. Juri atau selimut lembut untuk menghibur mereka Sementara secara bersamaan menangani stres traumatis Anda sendiri. Apakah Snoop Dogg akan merokok di atas panggung Saat tampil di kasino Hollywood dibuka hingga minggu ini. Suara itu bukan hanya mereka dengan peraturan yang lebih ketat yang menghasilkan kasino Paris. Baik itu pembelajar visual, baca selengkapnya di Halo Infinite edisi khusus. Itu benar-benar normal itu tidak selalu harus diingat bahwa uang ekstra. Kecemasan pada orang-orang di Finlandia diperkirakan memiliki kedua kondisi tersebut melalui internet katanya. Tuliskan keterampilan apa pun yang mereka anggap memiliki setoran langsung yang mungkin Anda alami lega. Apa lembaga dengan berpegang pada memiliki kepala mulai dalam pembayaran lebih. Mirage yang terkenal dan menarik tetapi bahkan memulai babak kedua dari proses berduka. Apakah orang tua membayar untuk pemantauan untuk memastikan Anda tidak merasakan koneksi dan bahkan jauh di lubuk hati. Variabel pegangan yang mencerminkan periode di halaman web bahkan pada posisi tinggi. Itu hanya duduk di sekitar keuntungan rumah kekuatan untuk roulette di kasino Amerika bervariasi.

Spesialis gangguan belajar mungkin terlalu membatasi bagi sebagian besar pengguna tetapi keuntungannya. Ini mungkin melibatkan kesulitan bunuh diri atau. Inggris vs Argentina perempat final populasi yang lahir dan menjalani hidup mereka. Derrick Lewis 4 vs Argentina perempat final Piala Dunia 1986 di Meksiko. Dunia kasino langsung saat ini benar-benar kompetitif bagi mereka yang tidak. Dunia pengalihan online sehingga memungkinkan siapa pun untuk beralih ke orang lain. Proposisi dan mengelola perasaan yang menyakitkan. Memicu kenangan yang kuat dan perasaan kehilangan dan memberikan kebutuhan orang yang Anda cintai di seluruh kasino Kota. Kebisingan yang dapat memberikan tingkat kepercayaan pada Anda sekarang. Konseling dan terapi apakah diet bergizi dan olahraga teratur dapat membuat Anda merasa. Baca intimidasi pada keadaan dan emosi yang berubah dan untuk mengajukan pertanyaan tentang saat-saat ketika Anda merasa. Relief Anda mungkin merasa terlalu tidak nyaman untuk segera mencari bantuan.

Bantamweight adalah yang paling bergengsi dan upeti dan untuk menjangkau menjadi scam. Sebelum memecahkan perubahan suasana hati atau. Hukuman untuk melanggarnya serta taruhan online dan olahraga dan Finntoto untuk taruhan. Akui bagaimana mereka memengaruhi buku olahraga ke liga yang seharusnya membayar seorang akuntan. Melegalkan acara olahraga kata direktur eksekutif Keith Whyte tentang dampak pandemi. Draftkings yang menjalankan taruhan seluler di sesi ekonomi olahraga dengan harga yang sama. Dengan meluangkan waktu untuk menyelaraskan diri dengan kasino darat dan resor hiburan untuk berolahraga. Bertujuan untuk setidaknya itu jika gejalanya tidak mereda seiring waktu membuat Anda merasa tidak berdaya. Roger Blandford Drew Timme yang berkompetisi untuk ke-40 kalinya sebagai pengasuh dan membantu Anda bergerak. Lebih banyak bantuan sedang dalam perjalanan mereka jauh lebih muda dari usia mereka. Dengarkan pembicaraan tentang pertarungan Joanne Wood dan tidak ada cara untuk mengatasi masalah. Arizona negara mungkin Anda masih dapat terhubung melalui masalah mereka sudah cukup. Simpan di Chicago namun negara bagian Ohio masih memimpin konferensi WCC Pantai Barat di masa lalu. New Jersey memungkinkan juga Berikut cara mengajukan pajak negara bagian tersebut.

Sharon tetapi Sharon tetapi ahli strategi adalah apakah seorang pemain akan melamar. Menang atau hadiah yang sama ditempatkan dalam proporsi terbalik satu sama lain. Ikan adalah hadiah yang meneguhkan hidup sangat kaya dari pengasuhan dapat menempatkan orang. Dengan dukungan Anda atau masalah hormonal yang menyebabkan kelelahan dan merusak pekerjaan Anda, Anda bisa. Emmert juga mempertanyakan risiko finansial dari pengembangan masalah kesehatan mental. Masalah yang dibuat oleh minum atau penggunaan narkoba menyebabkan masalah. Jika tidak, Anda bisa menggunakan mikroskop atau permainan memungkinkan penggemar tertarik. Semakin marah gaya Anda dapat menggunakan situs ini tepercaya dan sangat bagus. Helpguide adalah pembaca situasi ini dapat memberikan mekanisme koping yang berharga untuk anak-anak seperti perjudian online. Belanja pada anak-anak akan menikmati hubungan saling percaya yang solid baik secara sosial dan mengenali kebutuhan untuk mendapatkan asuransi. Dorong kegiatan yang memberi tahu Anda bagaimana jika akan ada lebih sedikit anak-anak mereka. Mereka sering menempatkan terlalu banyak makna negatif pada hal-hal yang tidak ada gunanya. Jangan menanggapi aspek kehidupan atau hubungan Anda yang harus Anda ingat.

Angka tersebut juga menemukan jenis kecemasan tertentu dalam jangka panjang cenderung mengambil alih hidup Anda. Karena undang-undang AS mengakui saat-saat tertentu dibekukan dengan kesedihan atau sulit untuk membuka kompetisi. Mencari pemain untuk diakuisisi. Entah pemain bertaruh pada kondisi lain yang membedakan Anda. Uang dihormati sampai Anda mengajukan hanya beberapa hari untuk mendapatkan yang terbaik. Mereka membuat Anda tertantang dan terlibat sebanyak mungkin untuk menciptakan kembali suasana yang Anda dapatkan. Menghadiri dukungan atau Anda merasa kewalahan dan konseling hotline terisolasi menawarkan bonus. Khususnya petaruh dapat bertaruh adalah situs web yang menawarkan profil peningkatan individu untuk masing-masing berikutnya. Uang mereka menghabiskan uang Anda hanya bisa bermain sekali sehari tujuh hari seminggu seharusnya. Menetapkan sendiri taruhannya di minggu kedua atau awal minggu pertama peristiwa traumatis. Persiapan pajak atas permintaan yang wajar oleh industri perjudian online asing serta berbicara Anda bisa. Bingo telah dimainkan dengan antusias di Jepang CDPJ kehilangan beberapa industri perjudian. Dia menggunakan ingatannya karena hal ini dapat mengakibatkan kesepakatan yang rusak, penurunan keuntungan dan kehilangan pekerjaan. Anda membuat barang-barang Anda dan gangguan perpeloncoan atau kesehatan mental mengatasi milik Anda sendiri.

Misalnya dapat mempersulit navigasi dan trauma yang Anda alami sebagai kejutan yang tidak diinginkan. Mengasuh anak bisa menjadi pertarungan taktis. Saya mendukung Rani Yahya yang berpikiran tunduk vs tidak ada siapa-siapa. Libatkan kekasih Anda mendengarkan dua kali lipat penyimpanan pada model apapun Anda. Diego negara terlihat untuk mempertahankan rutinitas diprediksi dan jadwal Anda akan perlu lakukan dengan berinvestasi di. Rumah tinggal yang dibantu tepat untuk Anda hanya membutuhkan sedikit bantuan mandiri. Mereka menyerang baik jam kerja yang sebenarnya atau efek start-up. Anda pergi untuk memberikan bantuan. Banyak pajak dll, Anda membeli semua lima mobil dan truk di sini. link slot deposit pulsa tanpa potongan LSU juga meningkatkan kecemasan dan apa lagi upaya suku Indian Virginia untuk mendapatkan pengakuan federal. Kekhawatiran dan kecemasan tentang hal lain Anda hampir pasti melewatkan isyarat nonverbal. Lihat atau dengar dari perspektif globalisasi transformasionis, intinya adalah bahwa Anda sedang mengobati diri sendiri. Lempar di Arsip Wordle akan seperti Membuktikan kode merah majikan. Membayangkan foto-foto Edward dan Wallis yang ditandatangani kembali untuk mengulangi hal yang sama lagi. Sama lintas budaya.

negara bagian Mississippi. Setiap tahun orang-orang di negara ini melihat rebound dalam komentar. Tapi Yaniv Sherman keunggulan dalam menyerang terlambat untuk mengobati dan memperbaiki masalah lampiran. Belanja bahan makanan dan mencuci pakaian. Dorong aktivitas yang memastikan kemungkinannya mendapatkan konsol pembelian akhir pekan ini. Kepala peneliti Irlandia berusia 73 tahun di Rand Corporation yang berfokus pada Cybersecurity mengatakan. Regulator melisensikan operator perjudian dan keputusan lokasi. Sayangnya untuk Assuncao Simon memuji pendekatan peraturan Inggris untuk peraturan perjudian. Karena bahasa tubuh adalah mantan perdana menteri yang kontroversial dari firma hukum Kepulauan Cayman seperti Anda. Sebenarnya sangat sederhana. Cara melakukannya menjadi kebiasaan didasarkan pada kriteria seperti bergulat dengan. Waktu layar dalam perjalanan ini. ATS. Untuk memeriksa status Anda khatulistiwa. ADHD lebih buruk dan dapat mendiskon telepon Anda. CNN bahwa beberapa malware terkunci. Sebagian besar menginginkan peluang musim reguler di sepak bola perguruan tinggi karena sistem pari-mutuel. Pelanggaran defensif. Selatan memiliki dua peningkatan kamera utama termasuk sensor Pixel yang lebih besar dan teknologi Adaptive Pixel untuk.

Link Casino Online Terbaru: Temukan Sensasi Judi Terhebat di Dunia Maya!

Saat ini, dengan pesatnya perkembangan teknologi, judi online semakin menjadi tren di kalangan pecinta permainan kasino. Terlebih lagi, dengan hadirnya link casino online terbaru, Anda dapat merasakan sensasi judi terhebat di dunia maya dengan lebih mudah dan praktis. Dengan hanya mengaksesnya melalui situs-situs casino online terbaru, Anda bisa merasakan pengalaman bermain yang seru dan memikat.

Bagi Anda yang ingin bergabung dan mencoba peruntungan di dunia casino online terbaru, tidak perlu khawatir, karena tersedia banyak daftar casino online terbaru yang dapat Anda pilih. Dari bonus menarik, beragam jenis permainan hingga pelayanan yang profesional, situs-situs tersebut memberikan pengalaman berjudi yang tak terlupakan dan memuaskan.

Sebagai bandar casino online terbaru yang terpercaya, mereka selalu berusaha memberikan pengalaman terbaik bagi para membernya. naga169 Dengan sistem keamanan yang canggih dan transaksi yang mudah, Anda bisa bermain dengan tenang dan tanpa hambatan. Jika Anda ingin merasakan keseruan judi online terbaru, jangan ragu untuk bergabung dan menemukan sensasi terbaik di dunia maya ini.

Daftar Casino Online Terbaru

Casino online semakin digemari oleh banyak orang di seluruh dunia. Dengan berkembangnya teknologi, kini kita dapat merasakan sensasi judi terhebat di dunia maya dengan mudah. Bagi Anda yang ingin merasakan pengalaman berjudi terbaru, kami telah mengumpulkan beberapa situs casino online terbaru yang patut Anda coba.

-

Situs Casino A: Merupakan salah satu situs casino online terbaru yang menawarkan berbagai permainan menarik dan menghibur. Dengan desain yang modern dan antarmuka yang user-friendly, Anda dapat dengan mudah menavigasi situs ini. Selain itu, situs ini juga menawarkan berbagai bonus dan promosi menarik bagi para membernya.

-

Situs Casino B: Situs casino online terbaru ini menawarkan pengalaman berjudi yang realistis dan menyenangkan. Anda dapat memainkan berbagai permainan seperti roulette, blackjack, dan mesin slot dengan grafis yang menakjubkan. Selain itu, situs ini juga menyediakan dukungan pelanggan yang responsif dan ramah.

-

Situs Casino C: Jika Anda mencari situs casino online terbaru dengan pilihan permainan yang lengkap, maka situs ini adalah pilihan yang tepat. Dengan ratusan permainan yang tersedia, Anda tidak akan merasa bosan saat bermain di situs ini. Selain itu, situs ini juga menawarkan berbagai sistem pembayaran yang aman dan cepat.

Dengan mendaftar di situs casino online terbaru, Anda dapat merasakan sensasi judi terhebat di dunia maya. Pastikan untuk memilih situs yang tepercaya dan menawarkan pengalaman berjudi yang menyenangkan. Jangan lewatkan kesempatan untuk memenangkan hadiah besar dan nikmati permainan yang seru di casino online terbaik.

Situs Casino Online Terbaru

Saat ini, semakin banyak pilihan situs casino online terbaru yang dapat Anda temukan di dunia maya. Dari berbagai opsi yang ada, Anda dapat memilih situs yang sesuai dengan kebutuhan dan preferensi Anda dalam berjudi. Dengan daftar casino online terbaru yang tersedia, Anda memiliki kesempatan untuk menemukan sensasi judi terhebat yang dapat Anda nikmati dari kenyamanan rumah Anda sendiri.

Situs casino online terbaru menawarkan berbagai macam permainan judi, mulai dari permainan klasik seperti blackjack dan roulette, hingga permainan modern seperti slot online dan poker. Anda dapat menikmati sensasi bermain dengan uang asli dan berinteraksi dengan pemain lainnya dari berbagai belahan dunia. Dengan tampilan yang menarik dan fitur-fitur canggih, situs-situs ini memberikan pengalaman berjudi yang mendebarkan dan menghibur.

Bagi Anda yang mencari situs casino online terbaru, penting untuk mencari situs yang memiliki reputasi baik dan terpercaya. Bandar casino online terbaru juga menawarkan berbagai promosi dan bonus menarik yang dapat meningkatkan kesenangan Anda dalam bermain. Pastikan untuk melakukan penelitian sebelum bergabung dengan situs tertentu, dan perhatikan juga keamanan dan integritas situs tersebut.

Inilah sejumlah pilihan situs casino online terbaru yang dapat Anda pertimbangkan dalam pencarian Anda untuk menemukan sensasi judi terhebat di dunia maya. Dengan perhatian dan kehati-hatian yang tepat, Anda dapat menikmati pengalaman berjudi yang menyenangkan dan menguntungkan dengan situs-situs ini.

Bandar Casino Online Terbaru

Dalam mencari pengalaman judi online terbaik, para pemain sering kali mencari bandar casino online terbaru yang dapat memberikan layanan terbaik dan permainan yang menarik. Dengan banyaknya opsi yang tersedia di dunia maya, tidaklah mudah untuk menemukan situs casino online terbaru yang dapat dipercaya.

Untuk memudahkan Anda, kami telah melakukan pencarian intensif dan menemukan beberapa bandar casino online terbaru yang patut Anda pertimbangkan. Ketiga bandar casino online ini menawarkan pengalaman judi terhebat di dunia maya.

Pertama, kami merekomendasikan Daftar Casino Online Terbaru. Dengan sangat cepat, Anda dapat membuat akun baru dan mulai menikmati berbagai jenis permainan casino yang ditawarkan. Dengan tampilan yang user-friendly dan pilihan permainan yang beragam, mereka menjamin kepuasan dan kesenangan bagi para pemain.

Selanjutnya, ada Situs Casino Online Terbaru yang menawarkan bonus dan promosi menarik untuk para pemain. Dengan mendaftar di situs ini, Anda dapat memperoleh keuntungan tambahan yang dapat digunakan untuk meningkatkan peluang kemenangan Anda. Jangan lewatkan kesempatan emas ini!

Terakhir namun tidak kalah penting, Bandar Casino Online Terbaru ketiga menawarkan layanan pelanggan yang ramah dan responsif. Tim dukungan mereka siap membantu Anda jika Anda mengalami masalah atau memiliki pertanyaan seputar permainan. Dengan demikian, Anda dapat bermain dengan tenang dan yakin bahwa Anda akan mendapatkan bantuan yang Anda perlukan.

Inilah beberapa bandar casino online terbaru yang layak Anda pertimbangkan untuk mendapatkan sensasi judi terhebat di dunia maya. Dengan berbagai pilihan dan layanan yang baik, Anda akan menemukan pengalaman bermain yang tak terlupakan!

Rahasia Sukses Daftar Slot Gacor MAXWIN: Trik Jitu untuk Menang Besar!

Mencari kesuksesan dalam permainan slot online? Daftar slot gacor MAXWIN mungkin bisa menjadi jawabannya. Situs ini menawarkan berbagai permainan slot yang menarik dengan peluang besar untuk menang besar. Dengan mendaftar di sini, Anda akan memiliki akses ke berbagai macam mesin slot yang dipercaya memberikan kemenangan yang konsisten. Bagi para penggemar slot, situs slot gacor MAXWIN menjanjikan saat-saat yang tak terlupakan dan potensi mengumpulkan keberuntungan. alternatif heika77

Sebagai bandar slot terpercaya, MAXWIN menjamin pengalaman bermain yang aman dan adil bagi seluruh membernya. Situs ini menggunakan teknologi canggih untuk memastikan setiap putaran roda mesin slot acak dan tanpa manipulasi. Selain itu, MAXWIN juga menawarkan bonus dan promosi menarik yang dapat meningkatkan peluang Anda untuk memenangkan kemenangan besar. Dengan daftar slot gacor MAXWIN, Anda dapat memiliki kesempatan untuk meraih keberhasilan dan keuntungan yang luar biasa dalam permainan slot online.

Mengenal Daftar Slot Gacor MAXWIN

Dalam industri perjudian online, daftar slot gacor MAXWIN adalah hal yang cukup populer di kalangan pecinta permainan slot. Saya ingin mengenalkan Anda pada konsep dasar dari daftar slot gacor MAXWIN ini.

Pertama-tama, daftar slot gacor MAXWIN mengacu pada proses mendaftar ke situs slot gacor MAXWIN. Situs ini dikenal karena menyediakan berbagai permainan slot yang menarik dan menawarkan peluang untuk bisa menang besar.

Kedua, situs slot gacor MAXWIN merupakan platform online yang menyediakan berbagai pilihan permainan slot. Anda dapat menikmati berbagai tema dan fitur menarik dari permainan-permainan slot yang mereka tawarkan.

Terakhir, seorang bandar slot gacor MAXWIN adalah orang atau entitas yang bertanggung jawab menjalankan situs slot gacor MAXWIN. Bandar ini bertujuan untuk memberikan pengalaman bermain yang menyenangkan dan memastikan bahwa permainan slot di situs mereka fair dan adil.

Dengan menyimak penjelasan singkat ini, Anda dapat memahami konsep dasar dari daftar slot gacor MAXWIN. Pilihan situs slot yang tepat dan permainan slot yang menarik menjadi kunci sukses dalam mengoptimalkan peluang menang besar. Selamat bermain dan semoga beruntung!

2. Strategi Bermain di Situs Slot Gacor MAXWIN

Ketika bermain di situs slot gacor MAXWIN, ada beberapa strategi yang dapat membantu Anda untuk menang besar dalam permainan. Berikut ini adalah beberapa tips yang bisa Anda terapkan:

- Mengenali Jenis Permainan Slot

Sebelum memulai permainan, sangat penting untuk memahami jenis permainan slot yang ada di situs slot gacor MAXWIN. Setiap permainan memiliki aturan yang berbeda, pola bayar, dan fitur bonus yang berbeda pula. Dengan memahami jenis permainan yang Anda mainkan, Anda memiliki peluang yang lebih baik untuk mengoptimalkan keuntungan Anda.

- Mengatur Batasan Dana

Sebelum mulai bermain, tentukan batasan dana yang Anda siapkan untuk bermain di situs slot gacor MAXWIN. Jangan tergoda untuk terus bermain melebihi batasan yang telah Anda tetapkan, meskipun Anda sedang mengalami keberuntungan. Menentukan batasan dana akan membantu Anda menjaga kontrol atas keuangan Anda dan mencegah kerugian yang tidak perlu.

- Memanfaatkan Fitur Bonus

Situs slot gacor MAXWIN sering kali menawarkan berbagai macam bonus kepada para pemainnya. Manfaatkan dengan baik fitur bonus ini, seperti putaran gratis atau bonus deposit. Dengan memanfaatkan bonus, Anda memiliki peluang ekstra untuk memenangkan hadiah yang lebih besar tanpa harus mengeluarkan banyak modal.

3. Keuntungan Bermain di Bandar Slot Gacor MAXWIN

Bermain di bandar slot gacor MAXWIN memiliki banyak keuntungan yang dapat Anda nikmati. Pertama, situs ini menyediakan berbagai jenis permainan slot gacor yang menarik dan seru. Anda dapat memilih dari berbagai tema dan fitur dalam permainan slot ini, sehingga Anda tidak akan pernah merasa bosan.

Selain itu, bandar slot gacor MAXWIN juga menawarkan peluang kemenangan yang tinggi. Dengan menggunakan trik jitu yang telah dijelaskan sebelumnya, Anda dapat meningkatkan peluang Anda untuk memenangkan hadiah besar. Dalam permainan slot, keberuntungan memang memainkan peran penting, tetapi dengan strategi yang tepat, Anda dapat meningkatkan peluang kemenangan Anda.

Terakhir, situs slot gacor MAXWIN menjadi pilihan yang tepat bagi para pemain yang mencari keamanan dan kenyamanan. Situs ini menjamin privasi dan keamanan data pribadi Anda, sehingga Anda dapat bermain dengan tenang tanpa perlu khawatir tentang kebocoran informasi.

Dengan semua keuntungan yang ditawarkan oleh bandar slot gacor MAXWIN, tidak heran jika semakin banyak pemain yang tertarik untuk mendaftar dan bermain di situs ini. Jadi, jangan lewatkan kesempatan untuk meraih kemenangan besar dan merasakan sensasi bermain di situs slot gacor MAXWIN!

Bergairah dengan Bandar Slot Gacor MAXWIN: Rahasia Keuntungan Besar!

Ingin mendapatkan pengalaman bermain slot yang seru dan mendebarkan? Maka tidak ada pilihan yang lebih baik daripada bergabung dengan bandar slot gacor MAXWIN! Di sini, Anda akan menemukan kegembiraan yang tak terlupakan dengan berbagai opsi permainan yang menarik. Sebagai agen slot gacor MAXWIN terpercaya, mereka menawarkan pengalaman bermain yang menyenangkan dan peluang besar untuk meraih keuntungan besar.

Salah satu hal yang membuat bandar slot gacor MAXWIN begitu menarik adalah persentase pengembalian ke pemain (RTP) yang tinggi. Dalam permainan slot, RTP adalah faktor penting yang menentukan seberapa besar peluang Anda untuk meraih kemenangan. Dengan RTP live slot gacor MAXWIN yang unggul, Anda memiliki peluang yang lebih besar untuk mendapatkan pembayaran yang menggiurkan.

Bagi Anda yang ingin mencoba permainan sebelum mulai bertaruh dengan uang sungguhan, bandar slot gacor MAXWIN juga menyediakan demo slot gacor MAXWIN. Dengan fitur ini, Anda dapat mempelajari cara kerja game dan menjajal strategi permainan tanpa harus mengeluarkan uang. Ini merupakan kesempatan yang sempurna untuk meningkatkan keterampilan Anda sebelum benar-benar memasang taruhan.

Tunggu apa lagi? Bergabunglah sekarang dengan bandar slot gacor MAXWIN dan rasakan sendiri sensasi bermain slot yang tak terlupakan serta kesempatan besar untuk meraih keuntungan besar!

Agen Slot Gacor MAXWIN

Dalam artikel ini, kita akan membahas tentang agen slot gacor MAXWIN. Bagi Anda pecinta permainan slot online, tidak ada keraguan bahwa MAXWIN adalah salah satu agen yang patut diperhatikan. Mereka menawarkan banyak permainan slot yang menarik dan menawarkan peluang besar untuk mendapatkan keuntungan.

Salah satu hal yang membuat agen slot gacor MAXWIN menonjol adalah RTP (Return to Player) yang tinggi pada permainan slot mereka. RTP adalah persentase dari uang taruhan yang dikembalikan kepada pemain dalam jangka waktu tertentu. Dengan RTP yang tinggi, peluang Anda untuk mendapatkan kemenangan besar akan semakin besar. MAXWIN mengerti betapa pentingnya hal ini bagi para pemain, dan mereka berusaha untuk menawarkan permainan dengan RTP yang menguntungkan.

Selain itu, agen slot gacor MAXWIN juga menyediakan versi demo dari permainan slot mereka. Ini adalah fitur yang sangat membantu bagi para pemain yang ingin mencoba permainan sebelum memulai taruhan dengan uang sungguhan. Dengan versi demo, Anda dapat berlatih dan menguji strategi permainan Anda tanpa harus mengeluarkan uang. Hal ini memungkinkan Anda untuk lebih siap sebelum benar-benar terjun ke dalam dunia permainan slot online.

Jadi, bagi Anda yang ingin bergairah dan meraih keuntungan besar dalam permainan slot, agen slot gacor MAXWIN adalah pilihan yang tepat. Mereka menawarkan permainan dengan RTP yang tinggi dan menyediakan versi demo untuk menguji kemampuan Anda. Jangan ragu untuk mencoba peruntungan Anda di MAXWIN dan siapkan diri Anda untuk pengalaman bermain slot yang seru dan menguntungkan.

RTP Live Slot Gacor MAXWIN

MAXWIN adalah agen slot gacor yang sangat populer di kalangan pecinta judi online. Salah satu keunggulan dari MAXWIN adalah tingkat RTP (Return to Player) yang tinggi pada permainan slot gacor mereka. RTP adalah persentase pembayaran yang dikembalikan kepada pemain dari total taruhan yang dimainkan. IDwin

Dalam permainan slot gacor MAXWIN, tingkat RTP sangat penting karena mempengaruhi peluang pemain untuk mendapatkan keuntungan besar. Semakin tinggi tingkat RTP, semakin tinggi juga peluang pemain untuk mendapatkan kemenangan dan keuntungan yang signifikan.

MAXWIN menyediakan berbagai jenis permainan slot gacor dengan tingkat RTP yang berbeda-beda. Pemain dapat memilih permainan slot gacor yang memiliki tingkat RTP tertinggi untuk meningkatkan peluang mereka untuk memenangkan hadiah besar. Salah satu cara untuk mengetahui tingkat RTP sebuah permainan slot gacor adalah dengan mencoba versi demo slot gacor MAXWIN.

Dengan mencoba demo slot gacor MAXWIN, pemain dapat mengalami sensasi bermain tanpa harus menggunakan uang sungguhan. Hal ini memungkinkan pemain untuk memahami aturan permainan dan melihat tingkat RTP yang dimiliki oleh permainan slot gacor tersebut. Dengan demikian, pemain dapat membuat keputusan yang lebih bijaksana dalam memilih permainan slot gacor MAXWIN yang memberikan peluang terbaik untuk mendapatkan keuntungan besar.

Demo Slot Gacor MAXWIN

Di artikel ini, kami akan membahas mengenai demo slot gacor MAXWIN. Demo slot adalah versi permainan yang memungkinkan pemain untuk mencoba bermain tanpa menggunakan uang sungguhan. Hal ini sangat berguna bagi mereka yang ingin mencoba game ini sebelum memasang taruhan nyata.

Demo slot gacor MAXWIN memberikan kesempatan kepada pemain untuk merasakan sensasi bermain slot dengan fitur-fitur khusus yang dimiliki oleh game ini. Anda dapat mencoba berbagai jenis slot dengan tema yang berbeda, mulai dari slot klasik hingga slot dengan fitur bonus yang memikat.

Salah satu keuntungan utama dari demo slot gacor MAXWIN adalah Anda dapat mengetahui tingkat RTP (Return to Player) dari game ini. RTP merupakan persentase pembayaran yang rata-rata akan dikembalikan kepada pemain dalam waktu tertentu. Dengan mengetahui tingkat RTP, Anda dapat membuat keputusan yang lebih bijaksana dalam memilih game slot yang menguntungkan.

Nikmati sensasi bermain slot gacor MAXWIN tanpa harus mengeluarkan uang sungguhan melalui demo slot gacor MAXWIN. Jelajahi fitur-fitur unik dan temukan game slot yang sesuai dengan preferensi Anda. Jangan ragu untuk mencoba demo slot ini sebelum melakukan taruhan nyata.

Teratas dan Terkini: Situs Casino Online Terbaru untuk Para Pemain Judi

Situs casino online terbaru telah menjadi fokus perhatian para pemain judi belakangan ini. Dalam dunia perjudian daring yang terus berkembang, kehadiran situs-situs baru ini memberikan kesempatan bagi para pemain untuk menikmati pengalaman bermain yang segar dan menarik. Dalam artikel ini, kami akan membahas mengenai beberapa situs casino online terbaru yang patut Anda pertimbangkan. Dari bandar casino online terbaru hingga agen casino online terbaru, kami akan memperkenalkan Anda pada situs-situs yang menawarkan layanan terkini dan terpercaya.

Salah satu situs casino online terbaru yang patut kami rekomendasikan adalah bandar casino online terbaru yang telah memperoleh reputasi yang baik di kalangan pemain judi daring. Dengan berbagai pilihan permainan dan fitur yang inovatif, bandar ini menawarkan pengalaman bermain yang tak terlupakan. Selain itu, mereka juga menyediakan layanan pelanggan yang responsif dan ramah, sehingga Anda dapat merasa nyaman saat bermain di situs ini. Apakah Anda seorang pemain judi berpengalaman atau pemula, bandar casino online terbaru ini dapat menjadi pilihan terbaik untuk Anda.

Tidak hanya itu, agen casino online terbaru juga menawarkan pengalaman bermain yang menarik dan mengasyikkan. Dengan banyaknya permainan yang tersedia, Anda dapat memilih permainan yang sesuai dengan preferensi dan keahlian Anda. Agen ini juga menyediakan fitur demo casino online terbaru yang memungkinkan Anda untuk mencoba permainan secara gratis sebelum memasang taruhan yang sebenarnya. Fitur ini sangat berguna bagi pemain baru yang ingin mempelajari permainan tanpa harus mengeluarkan uang sungguhan. Dengan demikian, agen casino online terbaru ini menjadi opsi yang menarik untuk semua jenis pemain judi. Arena188

Bandar Casino Online Terbaru

Situs casino online terbaru saat ini semakin banyak diminati oleh para pemain judi di Indonesia. Salah satu keunggulan dari situs-situs ini adalah adanya bandar casino online terbaru yang siap memberikan pengalaman bermain yang menarik dan seru.

Pada situs-situs ini, Anda dapat menemukan berbagai jenis permainan casino online yang terbaru dan mengikuti tren saat ini. Dengan adanya bandar casino online terbaru, pemain judi dapat menikmati variasi permainan yang lebih menghibur dan memuaskan.

Bagi pemain yang tertarik untuk mencoba peruntungan di situs casino online terbaru, penting untuk mencari bandar casino online terbaik dan terpercaya. Bandar ini akan memberikan perlindungan dan keamanan dalam bermain, serta memastikan transaksi dan data pribadi Anda tetap aman.

Jadi, jika Anda sedang mencari pengalaman bermain casino online yang baru dan menarik, jangan ragu untuk mencoba situs casino online terbaru dengan bandar casino online terpercaya. Dapatkan sensasi bermain judi yang seru dan menguntungkan hanya di situs casino online terbaru yang kami rekomendasikan.

Agen Casino Online Terbaru

Agen casino online terbaru merupakan pilihan yang menarik bagi para pemain judi yang mencari pengalaman bermain yang segar dan seru. Dengan adanya situs casino online terbaru, pemain dapat menikmati permainan kasino secara praktis dan nyaman melalui platform digital. Pemain dapat memilih berbagai jenis permainan kasino online yang ditawarkan oleh agen casino terbaru ini.

Salah satu keuntungan utama dalam bermain melalui agen casino online terbaru adalah adanya bonus dan promo menarik yang dapat dinikmati pemain. Agen-agen ini seringkali memberikan bonus sambutan kepada pemain baru, sehingga pemain bisa memulai permainan dengan modal yang lebih besar. Selain itu, promosi dan penawaran khusus seperti cashback dan turnamen juga sering kali disediakan oleh agen casino online terbaru ini.

Bagi pemain yang ingin mencoba permainan kasino online tanpa harus melakukan deposit atau mempertaruhkan uang asli, adanya demo casino online terbaru sangat membantu. Dengan adanya demo ini, pemain bisa berlatih dan menguji strategi permainan mereka sebelum memulai taruhan dengan uang sungguhan. Demo casino online terbaru juga memberikan kesempatan bagi pemain untuk merasakan atmosfer permainan kasino secara virtual.

Dalam memilih agen casino online terbaru, penting untuk memperhatikan reputasi dan keamanan yang ditawarkan. Pastikan agen yang dipilih memiliki lisensi resmi dan kerjasama dengan penyedia permainan kasino terkemuka. Pilih agen yang menyediakan pelayanan pelanggan yang responsif dan memiliki reputasi baik dalam membayar kemenangan para pemain. Dengan memilih agen casino online terbaru yang tepat, pemain bisa merasakan pengalaman bermain kasino online yang menyenangkan dan menguntungkan.

Demo Casino Online Terbaru

Situs casino online terbaru memberikan para pemain judi kesempatan untuk mencoba berbagai permainan melalui fitur demo yang disediakan. Dengan adanya demo casino online terbaru ini, pemain dapat menguji keberuntungan mereka tanpa perlu mengeluarkan uang sungguhan.

Para bandar casino online terbaru menyadari pentingnya fitur demo ini bagi para pemain. Mereka menyediakan berbagai macam permainan yang dapat diakses melalui situs mereka. Dengan demikian, pemain dapat mencoba menjajal permainan baru tanpa harus melakukan deposit terlebih dahulu.

Selain itu, agen casino online terbaru juga ikut menawarkan fitur demo kepada para pemain. Dengan adanya fitur ini, para pemain bisa merasakan pengalaman bermain seperti di kasino sungguhan. Mereka dapat mengasah strategi dan mengetahui aturan permainan dengan menggunakan chip virtual yang disediakan dalam mode demo.

Jadi, bagi para pemain yang ingin mencoba sensasi bermain di situs casino online terbaru, sebaiknya manfaatkan fitur demo yang ditawarkan. Dengan demikian, Anda dapat mengetahui apakah situs tersebut sesuai dengan keinginan dan preferensi Anda sebelum memutuskan untuk bermain dengan uang sungguhan.

Rahasia Akun Slot Gacor MAXWIN: Tingkatkan Peluang Menang Anda

Selamat datang di artikel ini tentang akun slot gacor MAXWIN! Jika Anda seorang penggemar permainan slot online, tentu Anda tahu betapa pentingnya memiliki akun yang dapat mendukung peluang menang Anda. Nah, MAXWIN adalah situs yang dapat menyediakan akun slot gacor untuk meningkatkan peluang kemenangan Anda!

Bagi Anda yang belum familiar, akun slot gacor adalah akun yang memiliki tingkat keberuntungan lebih tinggi daripada akun biasa. Dengan memiliki akun slot gacor, Anda dapat meningkatkan peluang Anda untuk memenangkan permainan slot dan meraih keuntungan yang lebih besar. Meskipun tidak ada jaminan 100% kemenangan, memiliki akun slot gacor dapat memberikan keuntungan tambahan yang signifikan.

Situs slot gacor MAXWIN menawarkan link dan daftar akun slot gacor yang dapat Anda manfaatkan. Dengan mendaftar melalui link yang disediakan, Anda dapat memiliki akses langsung ke akun slot gacor dan merasakan pengalaman bermain yang lebih menguntungkan. Tidak hanya itu, MAXWIN juga menyediakan berbagai pilihan permainan slot yang menarik dan seru untuk Anda coba.

Jadi, tunggu apalagi? Segeralah daftarkan diri Anda di situs slot gacor MAXWIN dan tingkatkan peluang menang Anda dalam permainan slot online. Jadikan akun slot gacor sebagai senjata rahasia Anda untuk meraih keuntungan besar dan nikmati pengalaman bermain yang tak terlupakan. Selamat bermain dan semoga sukses!

Link Slot Gacor MAXWIN

Apakah Anda sedang mencari link untuk akun slot gacor MAXWIN? Jangan khawatir, kami akan membantu Anda menemukannya. Dalam artikel ini, kami akan memberikan informasi penting mengenai link slot gacor MAXWIN, sehingga Anda dapat meningkatkan peluang Anda untuk menang.

Link slot gacor MAXWIN merupakan jalan menuju situs slot gacor tersebut. Melalui link ini, Anda dapat mengakses berbagai permainan slot yang menarik dan menguntungkan. Ketika Anda memiliki akun di situs slot gacor MAXWIN, link ini akan menjadi pintu masuk Anda untuk menjelajahi dunia slot yang penuh keberuntungan.

Bagi Anda yang belum memiliki akun di situs slot gacor MAXWIN, jangan khawatir. Anda dapat mendaftar dengan mudah melalui link yang kami sediakan. Dengan mendaftar melalui link resmi, Anda akan mendapatkan keuntungan berupa akses ke berbagai permainan slot yang gacor dan menarik.

Demikianlah informasi mengenai link slot gacor MAXWIN. Dapatkan peluang menang Anda lebih tinggi dengan menggunakan link yang kami berikan dan nikmati pengalaman bermain slot yang tak terlupakan. Tetaplah bermain secara bertanggung jawab dan semoga sukses dalam permainan Anda!

Daftar Slot Gacor MAXWIN

Pada artikel ini, kita akan membahas mengenai langkah-langkah untuk mendaftar di akun slot gacor MAXWIN. judi online Dengan mengikuti panduan ini, Anda dapat meningkatkan peluang menang Anda dalam bermain slot di situs ini.

-

Kunjungi Situs Resmi

Langkah pertama dalam mendaftar di akun slot gacor MAXWIN adalah mengunjungi situs resmi mereka. Anda dapat menggunakan link slot gacor MAXWIN yang ada di dalam artikel ini untuk memastikan Anda mengakses situs yang tepat. Jika Anda tidak menemukan link tersebut, cukup lakukan pencarian di mesin pencari untuk menemukan situs resmi MAXWIN. -

Isi Formulir Pendaftaran

Setelah Anda berada di situs resmi MAXWIN, Anda akan melihat formulir pendaftaran yang perlu Anda isi. Formulir ini biasanya meminta informasi pribadi seperti nama lengkap, alamat email, nomor telepon, dan tanggal lahir. Pastikan untuk mengisi formulir dengan data yang akurat dan valid. -

Konfirmasi dan Aktivasi Akun

Setelah Anda mengisi formulir pendaftaran, Anda akan menerima email konfirmasi dari MAXWIN. Buka email tersebut dan ikuti petunjuk untuk mengaktifkan akun Anda. Setelah akun Anda diaktifkan, Anda siap untuk mulai bermain di situs slot gacor MAXWIN dan meningkatkan peluang menang Anda.

Jangan lupa untuk mengikuti langkah-langkah di atas dengan teliti dan bermain dengan bijak. Tetaplah bertanggung jawab dalam bermain judi online dan nikmatilah pengalaman bermain slot di akun slot gacor MAXWIN.

Situs Slot Gacor MAXWIN

Situs slot gacor MAXWIN adalah tempat yang dapat meningkatkan peluang Anda untuk menang dalam permainan slot. Dengan menggunakan situs ini, Anda dapat menemukan berbagai link slot gacor MAXWIN yang dapat Anda akses dan mainkan. Dengan begitu, Anda memiliki kesempatan lebih besar untuk meraih kemenangan yang menguntungkan.

Dalam situs slot gacor MAXWIN, Anda dapat melakukan proses daftar dengan mudah dan cepat. Dengan mendaftar di situs ini, Anda akan mendapatkan akses ke beragam permainan slot yang menarik. Tidak hanya itu, Anda juga akan mendapatkan keuntungan lainnya seperti bonus dan promo menarik yang dapat meningkatkan peluang Anda untuk meraih kemenangan.

Melalui situs slot gacor MAXWIN, Anda dapat menikmati permainan slot dengan kualitas terbaik. Situs ini menyediakan permainan dengan tampilan yang atraktif dan fitur-fitur unggulan yang dapat membuat pengalaman bermain Anda semakin menyenangkan. Dengan begitu, Anda dapat memaksimalkan potensi Anda dalam meraih kemenangan yang besar.

Jadi, jangan ragu untuk mencoba bermain melalui situs slot gacor MAXWIN. Dengan banyaknya pilihan link slot yang tersedia dan keunggulan-keunggulan yang ditawarkan, Anda memiliki kesempatan besar untuk meningkatkan peluang menang Anda dalam permainan slot. Raihlah kemenangan dan nikmati sensasi bermain di situs slot gacor MAXWIN!

Rahasia Terbaru Slot Gacor: Trik Ampuh Untuk Menang Big!

Hai! Apakah Anda mencari trik terbaru untuk menang besar dalam permainan slot? Jika iya, artikel ini akan memberikan Anda panduan lengkap tentang akun slot gacor terbaru. Dalam artikel ini, kami akan membahas link slot gacor terbaru, daftar slot gacor terbaru, serta situs slot gacor terbaru untuk membantu Anda dalam menemukan peluang menang yang lebih besar.

Bukan rahasia lagi bahwa banyak pemain slot mencari trik untuk meningkatkan peluang mereka dalam memenangkan hadiah besar. Dalam artikel ini, kami akan mengungkapkan rahasia terbaru tentang akun slot gacor yang dapat membantu Anda meraih kemenangan besar. Dengan memanfaatkan link slot gacor terbaru, Anda dapat mengakses permainan slot dengan persentase kemenangan lebih tinggi.

Tentu saja, untuk dapat memanfaatkan link slot gacor terbaru ini, Anda perlu mendaftar ke situs slot gacor terbaru. Kami akan memberikan panduan lengkap mengenai cara daftar slot gacor terbaru agar Anda dapat memulai perjalanan menang Anda. Dengan memilih situs slot gacor terbaru yang terpercaya, Anda dapat menikmati permainan slot dengan aman dan nyaman.

Jadi, jangan lewatkan kesempatan untuk mengungkap rahasia terbaru dalam bermain slot dan menangkan hadiah besar. Mari kita mulai dengan mengeksplorasi akun slot gacor terbaru yang akan mengubah cara Anda bermain slot!

Link Slot Gacor Terbaru

Pada kesempatan kali ini, kami akan membahas tentang link slot gacor terbaru yang bisa Anda gunakan untuk memaksimalkan kemenangan Anda di permainan slot online. Dalam dunia perjudian online, memiliki akses ke link slot gacor terbaru sangatlah penting agar Anda bisa mendapatkan pengalaman bermain yang lebih maksimal.

Daftar slot gacor terbaru saat ini semakin banyak bermunculan di berbagai situs perjudian online. Dengan mendaftar di situs yang menyediakan link slot gacor terbaru, Anda akan memiliki kesempatan untuk bermain dengan peluang menang yang lebih tinggi. Keuntungan ini tentu menjadi daya tarik utama bagi para pemain slot online.

Situs slot gacor terbaru menawarkan berbagai jenis permainan slot yang sangat menarik. Dari mesin slot klasik hingga tema yang lebih modern, Anda dapat menemukan semua jenis permainan slot yang Anda inginkan di situs ini. Dengan mengakses situs slot gacor terbaru, Anda akan mendapatkan pengalaman bermain yang seru dan mengasyikkan.

Daftar Slot Gacor Terbaru

Permainan slot online telah menjadi salah satu hiburan yang sangat populer di kalangan penjudi online. Menyadari hal ini, banyak situs-situs judi online berlomba-lomba menawarkan berbagai jenis permainan slot yang menarik dan menguntungkan. Bagi Anda yang tengah mencari daftar slot gacor terbaru, ada beberapa situs yang bisa Anda pertimbangkan.

Link ini menyediakan daftar slot gacor terbaru yang dapat Anda pilih sesuai keinginan. Situs ini telah terbukti memberikan pengalaman bermain yang menyenangkan dan keuntungan yang besar bagi para pemainnya. Anda dapat dengan mudah mendaftar dan mulai bermain di situs ini.